Safe Harbor Quarterly Tax Payments . For estimated tax purposes, a year has four payment periods. When it comes to the estimated payment of taxes, you may owe the penalty for underpayment unless you adhere to these “safe harbor” provisions outlined by the irs: If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. Taxpayers must make a payment each. If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. When to pay estimated taxes. The “safe harbor” rule of estimated tax payments. Make all of your federal tax payments including federal tax deposits (ftds), installment agreement and estimated tax. The irs may impose penalties on quarterly tax payments for a few reasons: Not paying enough tax for the year; If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may.

from www.slideserve.com

When it comes to the estimated payment of taxes, you may owe the penalty for underpayment unless you adhere to these “safe harbor” provisions outlined by the irs: If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. Make all of your federal tax payments including federal tax deposits (ftds), installment agreement and estimated tax. The “safe harbor” rule of estimated tax payments. Not paying enough tax for the year; The irs may impose penalties on quarterly tax payments for a few reasons: For estimated tax purposes, a year has four payment periods. If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may. Taxpayers must make a payment each.

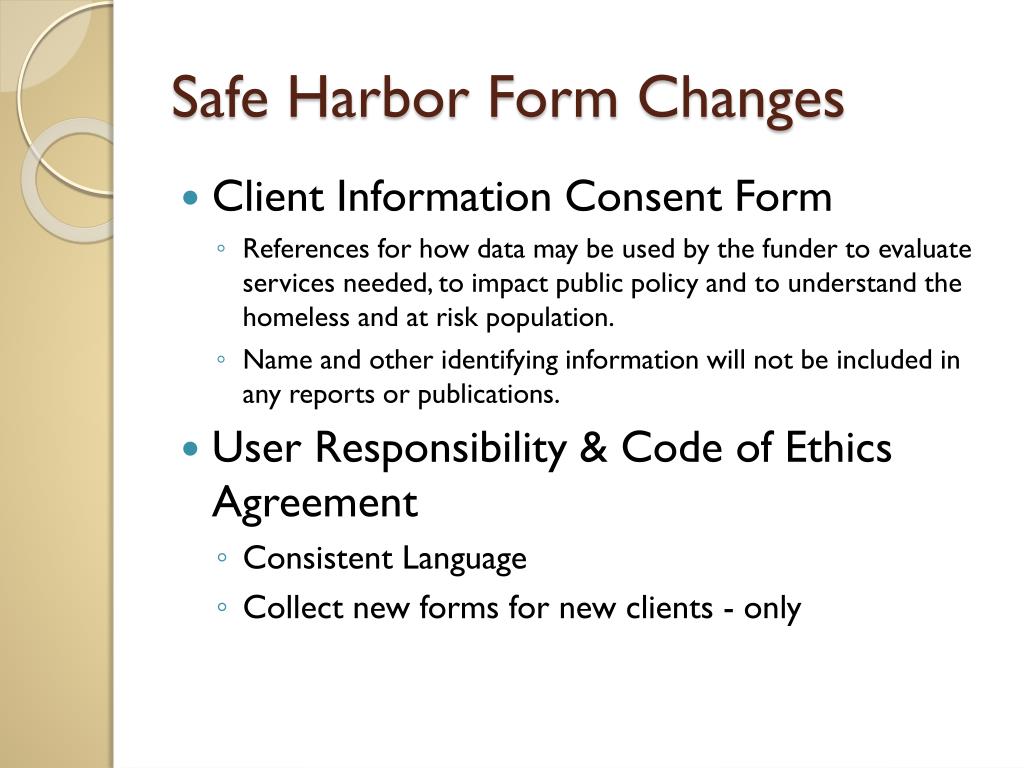

PPT Safe Harbors Quarterly Partner’s Meeting PowerPoint Presentation

Safe Harbor Quarterly Tax Payments The “safe harbor” rule of estimated tax payments. For estimated tax purposes, a year has four payment periods. Not paying enough tax for the year; If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. When it comes to the estimated payment of taxes, you may owe the penalty for underpayment unless you adhere to these “safe harbor” provisions outlined by the irs: When to pay estimated taxes. Make all of your federal tax payments including federal tax deposits (ftds), installment agreement and estimated tax. If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may. The “safe harbor” rule of estimated tax payments. If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. The irs may impose penalties on quarterly tax payments for a few reasons: Taxpayers must make a payment each.

From media.corporate-ir.net

Safe Harbor Statement Safe Harbor Quarterly Tax Payments For estimated tax purposes, a year has four payment periods. Make all of your federal tax payments including federal tax deposits (ftds), installment agreement and estimated tax. Not paying enough tax for the year; The irs may impose penalties on quarterly tax payments for a few reasons: If you expect to owe more than $1,000 in federal taxes for the. Safe Harbor Quarterly Tax Payments.

From www.pdffiller.com

2019 Formulaire CA FTB 100S Remplir en ligne, Imprimé, Fillable, Vide Safe Harbor Quarterly Tax Payments If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. The irs may impose penalties on quarterly tax payments for a few reasons: Taxpayers must make a payment each. If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may. Not paying enough tax. Safe Harbor Quarterly Tax Payments.

From www.youtube.com

Tax Estimator 2021 3rd Quarter Estimated Tax Payments Explained [How Safe Harbor Quarterly Tax Payments If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may. The “safe harbor” rule of estimated tax payments. If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. If you pay 100% of the. Safe Harbor Quarterly Tax Payments.

From www.youtube.com

091 Using The Safe Harbor Method for Quarterly Estimated Tax Payments Safe Harbor Quarterly Tax Payments For estimated tax purposes, a year has four payment periods. The “safe harbor” rule of estimated tax payments. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using. Safe Harbor Quarterly Tax Payments.

From alloysilverstein.com

Do I Need to Pay Estimated Taxes? An FAQ Cheat Sheet Alloy Silverstein Safe Harbor Quarterly Tax Payments Make all of your federal tax payments including federal tax deposits (ftds), installment agreement and estimated tax. When it comes to the estimated payment of taxes, you may owe the penalty for underpayment unless you adhere to these “safe harbor” provisions outlined by the irs: Not paying enough tax for the year; For estimated tax purposes, a year has four. Safe Harbor Quarterly Tax Payments.

From www.slideserve.com

PPT Safe Harbors Quarterly Partner’s Meeting PowerPoint Presentation Safe Harbor Quarterly Tax Payments For estimated tax purposes, a year has four payment periods. If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. The “safe harbor” rule of estimated tax payments. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re. Safe Harbor Quarterly Tax Payments.

From safeharborpartners.com

2021 Quarter 2 Review Safe Harbor Partners Safe Harbor Quarterly Tax Payments Taxpayers must make a payment each. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. When it comes to the estimated payment of taxes, you may owe the penalty for underpayment unless you adhere to these “safe harbor” provisions outlined by the irs: The irs may impose penalties on quarterly tax payments. Safe Harbor Quarterly Tax Payments.

From www.youtube.com

15 percent Safe Harbor For Alternating Tax Credits YouTube Safe Harbor Quarterly Tax Payments Not paying enough tax for the year; Make all of your federal tax payments including federal tax deposits (ftds), installment agreement and estimated tax. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. The irs may impose penalties on quarterly tax payments for a few reasons: When to pay estimated taxes. For. Safe Harbor Quarterly Tax Payments.

From www.groom.com

IRS Updates Safe Harbor Methods for “Substantially Equal Periodic Safe Harbor Quarterly Tax Payments The “safe harbor” rule of estimated tax payments. For estimated tax purposes, a year has four payment periods. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may. If you expect to owe. Safe Harbor Quarterly Tax Payments.

From www.thebottomlinecpa.com

Using The Safe Harbor Method for Quarterly Estimated Tax Payments The Safe Harbor Quarterly Tax Payments For estimated tax purposes, a year has four payment periods. When to pay estimated taxes. The “safe harbor” rule of estimated tax payments. The irs may impose penalties on quarterly tax payments for a few reasons: If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments. Safe Harbor Quarterly Tax Payments.

From www.thetaxadviser.com

Application of Partial Asset Dispositions and the De Minimis Safe Harbor Safe Harbor Quarterly Tax Payments For estimated tax purposes, a year has four payment periods. If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. Not paying enough tax for the year;. Safe Harbor Quarterly Tax Payments.

From safeharborpartners.com

2022 Quarter 2 Review Safe Harbor Partners Safe Harbor Quarterly Tax Payments The irs may impose penalties on quarterly tax payments for a few reasons: When to pay estimated taxes. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. Not paying enough tax for the year; If you expect to owe more than $1,000 in federal taxes for the tax year, you may need. Safe Harbor Quarterly Tax Payments.

From www.youtube.com

Safe Harbor and Estimated Tax Payments YouTube Safe Harbor Quarterly Tax Payments If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. Make all of your federal tax payments including federal tax deposits (ftds), installment agreement and estimated tax. For estimated tax purposes, a year has four payment periods. If you didn't pay enough tax throughout. Safe Harbor Quarterly Tax Payments.

From www.youtube.com

What Is A Safe Harbor 401(k)? A 2022 Guide For Financial Advisors And Safe Harbor Quarterly Tax Payments Make all of your federal tax payments including federal tax deposits (ftds), installment agreement and estimated tax. When to pay estimated taxes. If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. The “safe harbor” rule of estimated tax payments. Not paying enough tax. Safe Harbor Quarterly Tax Payments.

From www.financialsamurai.com

How To Pay Estimated Taxes And Follow The Safe Harbor Rule Safe Harbor Quarterly Tax Payments The “safe harbor” rule of estimated tax payments. When it comes to the estimated payment of taxes, you may owe the penalty for underpayment unless you adhere to these “safe harbor” provisions outlined by the irs: Not paying enough tax for the year; The irs may impose penalties on quarterly tax payments for a few reasons: For estimated tax purposes,. Safe Harbor Quarterly Tax Payments.

From www.financestrategists.com

What Are the Types of 401(k) Plans? Definition and Advantages Safe Harbor Quarterly Tax Payments If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. For estimated tax purposes, a year has four payment periods. The irs may impose penalties on quarterly tax payments for a few reasons: If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may.. Safe Harbor Quarterly Tax Payments.

From www.slideserve.com

PPT Safe Harbors Quarterly Partner’s Meeting PowerPoint Presentation Safe Harbor Quarterly Tax Payments When to pay estimated taxes. For estimated tax purposes, a year has four payment periods. If you pay 100% of the previous year’s tax liability via estimated quarterly tax payments, you’re safe. If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may. If you expect to owe more than $1,000. Safe Harbor Quarterly Tax Payments.

From financialsuccessmd.com

How Retirees Can Avoid Paying Quarterly Taxes Without Getting Penalized Safe Harbor Quarterly Tax Payments The “safe harbor” rule of estimated tax payments. Taxpayers must make a payment each. The irs may impose penalties on quarterly tax payments for a few reasons: If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form. If you pay 100% of the previous. Safe Harbor Quarterly Tax Payments.